The Retirement Newsletter: When I’m 67!

Issue Number: -93— Can I get a better overall retirement?

Welcome

Welcome to issue -93 — When I’m 67!

The Beatle sang: When I’m Sixty Four — well, it turns out that in the UK, turning 67 is important for your pension income.

This week, I will look at the significance of the 67th birthday in the UK.

Money

OK, first off, I want to say that I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. This is not financial advice.

In the last newsletter — Issue -94 — Quarterly review — I looked at how my plans to retire were going. In the issue, I also looked at how recent changes to the National Insurance (NI — a type of tax in the UK) rate and the NI threshold would impact retirement income. However, turning 67 in the UK can significantly boost your pension income. At 67, you stop paying NI and can start to take your State Pension.

National Insurance (NI) — UK

National Insurance (NI) is a tax you pay in the UK on top of income tax. At the time of writing, the NI rate in the UK is 13.25% on all earnings above £9,568 per year. The rate increases again at £50,260 — anything above £50,260, you pay an extra 3.25%. However, that is not a problem for most retirees as their gross income does not exceed £50,260 per year.

The money raised through NI goes to paying the pension of current pensioners, supporting the National Health Service (NHS), maternity cover, bereavement support, and jobseeker’s allowance.

In July 2022, the threshold for NI will increase from £9,568 per year to £12,570. This effectively brings the NI threshold in line with the income tax threshold.

However, unlike income tax, you stop paying NI in the UK when you reach the official government retirement age of 67. At that age, your state pension starts — although you can delay taking your state pension should you so choose.

State pension — UK

You could start to take your UK state pension at 67. Or you can decide to delay it to a later date and claim more. At 67, assuming you have made enough NI contributions (see below for some useful links that will allow you to estimate your UK state pension), you can claim £9,300 per year from the government as a pension. You will still be taxed on your earnings, but you will stop paying NI. (You should have spotted that the £9,300 — which is well below the amount needed for an ‘essentials’ retirement (see below) — is less than the tax threshold of £12,579. So, you won’t pay tax on the UK state pension, but you will pay tax on anything over the tax threshold of £12,579.)

Income and tax changes at 67

On your 67th birthday, you stop paying NI at 13.25% per year, and you get a State Pension. So, this means that you get a 13.25% increase in the value of your pension that is above the NI threshold (currently £13,250). You also get an extra income of about £9,300 per year from the State Pension — assuming you have made enough NI contributions. These changes can have a significant impact on your take-home pension.

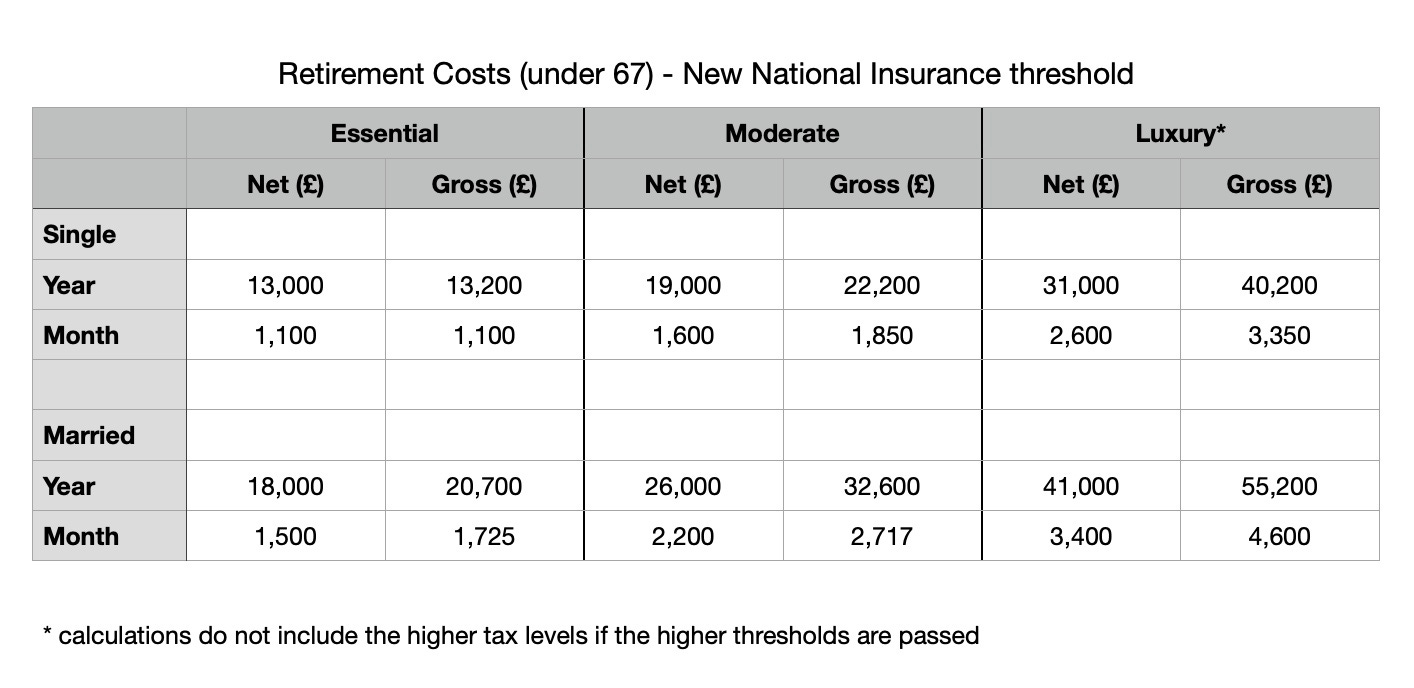

In previous newsletters (Issue -125: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement? and Issue -119: How much do you need to retire? The maths!), I looked at the income you would need for essentials, a moderate, and a luxury retirement. As a reminder, these levels of retirement are:

Essential — the least amount of money you need to survive. Not the most comfortable way to be retired, but at least you can be retired and have some freedom, albeit limited by money. Net income needed if under 67 would be — single: £13,000 per year; married: £18,000 per year.

Moderate — a comfortable retirement. A retirement where you are not overly limited by or worried about money. A retirement where you can travel and do things you want to do. Net income needed if under 67 would be —single: £19,000 per year; married: £26,000 per year.

Luxury — a retirement where money isn't a serious concern. You can't go mad, but you can afford some very nice holidays and have a very comfortable lifestyle. Net income needed if under 67 would be — single: £31,000 per year; married: £41,000 per year.

And the gross incomes required if you are not over 67, with a NI rate of 13.25%, an income tax rate of 20%, and the tax/NI threshold of £13,250 are:

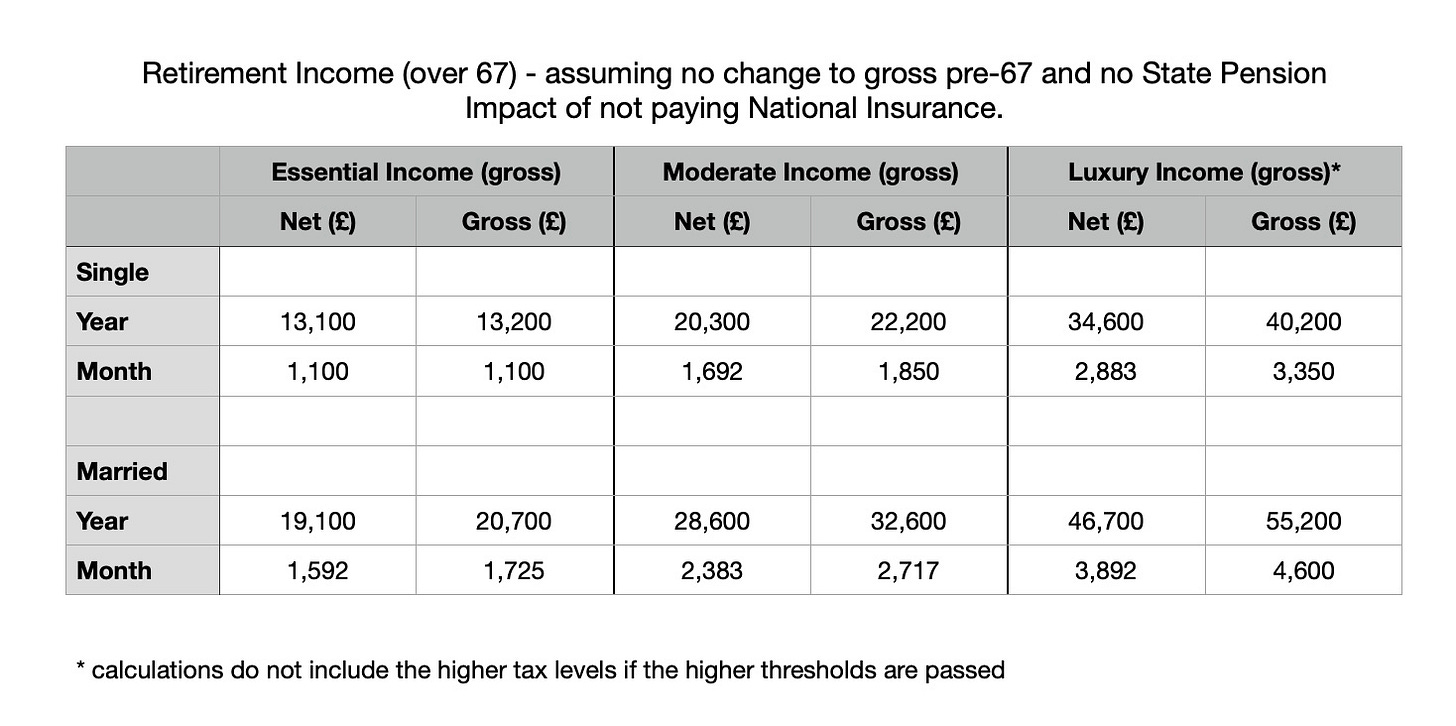

With the removal of NI at 67 (but still paying tax at 20% on income over £12,579), the net income, assuming no changes in gross income, is:

So, because of the National Insurance threshold of £13,250, not a significant increase. But, when you factor in the state pension of £9,300, we see:

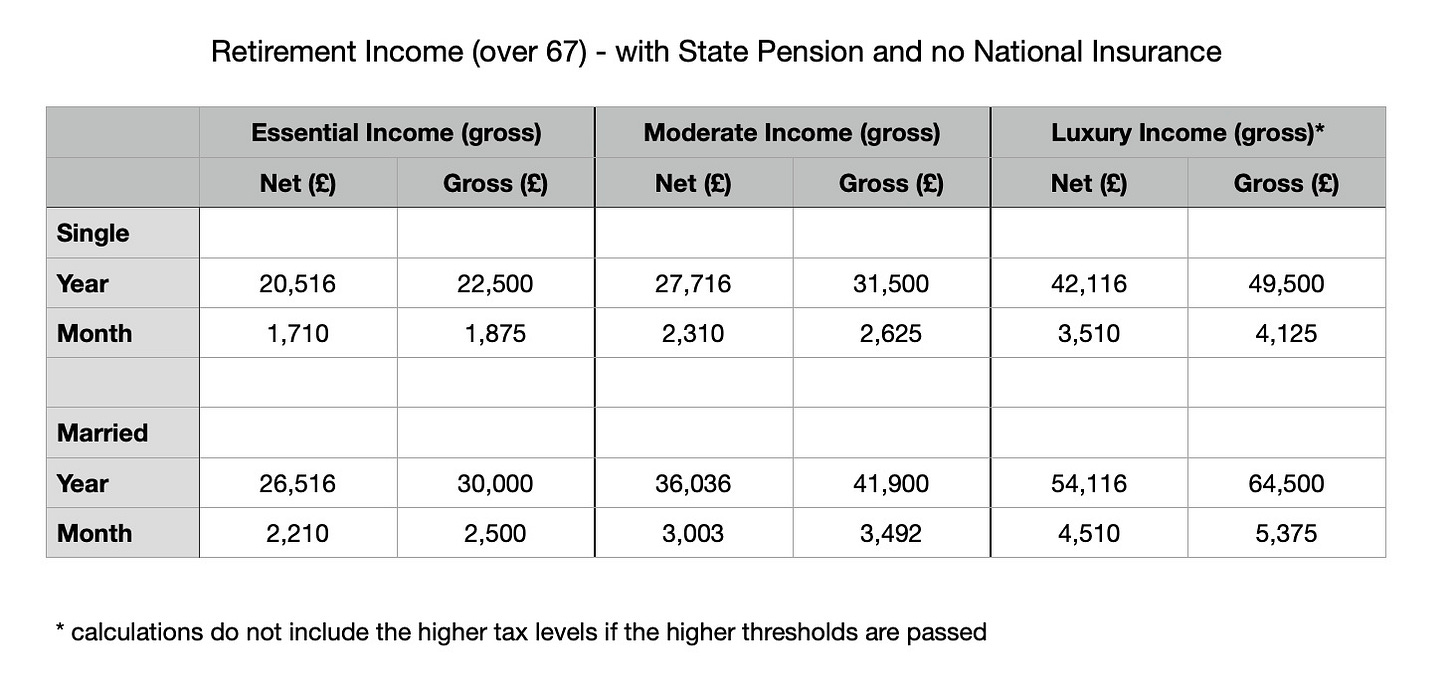

And there are some significant changes.

Assuming that the pre-67 gross income is maintained, we see:

Essential — Net income needed if under 67 would be — single: £13,000 per year; married: £18,000 per year — increases to £20,500 and £26,500, respectively. So, a significant change, the addition of the State Pension and no NI payments, moves an ‘Essentials’ retiree to the ‘Moderate’ group.

Moderate — Net income needed if under 67 would be — single: £19,000 per year; married: £26,000 per year — increases to £27,700 and £36,000, respectively. So, not quite enough to move a ‘moderate’ retiree to the ‘luxury’ group, but still a nice little bump on income.

Luxury — Net income, if under 67, would be — single: £31,000 per year; married: £41,000 per year — increases to £42,000 and £54,000, respectively. Again, a nice boost in income.

So, across the board, significant increases in pension incomes of all groups. However, for people on an essentials pension, no longer paying NI and getting the State Pension moves them from essentials and moderate. A significant change in circumstances and lifestyle.

Summary

No longer paying NI and taking the State Pension at 67 can significantly impact the quality of retirement for all pension groups in the UK. However, the biggest impact is for people who retired on an ‘essentials’ pension before they were 67 as they move from ‘essentials’ to ‘moderate’.

So, the question is, what can you do to push your pre-67 income from essential to moderate? I have looked at one thing you can do — side-hustles (see Issue Number: -95 — The advantages of hobbies and side-hustles), but is there anything else you can do? Well, that be the subject of a later issue.

Please note I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. This is not financial advice.

Useful links

UK Government Website:

Next week

Next week, in issue -92, I will start to look at some side-hustles you could do to boost your pension income and improve your lifestyle.

Thanks

Thanks for reading this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you would like to say 'thanks' for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you have something you would like to contribute to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial advisor. When I am writing about money and financial matters, it is based on things I have read about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE.