Welcome

Welcome to issue -94, and as it is the end of the quarter, it is time for another review of how my retirement plans are going.

This week, I will also look at the possible impact of the UK’s Chancellor of the Exchequer Spring Statement on pensions.

End of the first quarter

My last review was in Issue -106: How is my retirement plan going? and in that review, I looked at the four key areas of the plan:

Money

Job

Health

Life

And concluded:

Money — “So, I am still happy with how things are progressing with the 'Money List’”.

Job — “The job list is active again. I'm keeping an eye on the job listings and keeping a wary eye on what university management is doing.”

Health — “All OK. I just need to drop a few pounds.”

Life — “Over the next few months, I need to focus on the 'Life' list more.”

So, where do I now stand?

Money

OK, first off, I want to say that I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. This is not financial advice.

Over the last few months, the value of my stocks and shares ISA (Individual Savings Accounts) has taken a bit of a hammering. I can’t think why? Over the year, it has performed well and has recovered some of the drop in the last month. (You watch, it will now plummet like a stone.). I still consider it to be on track.

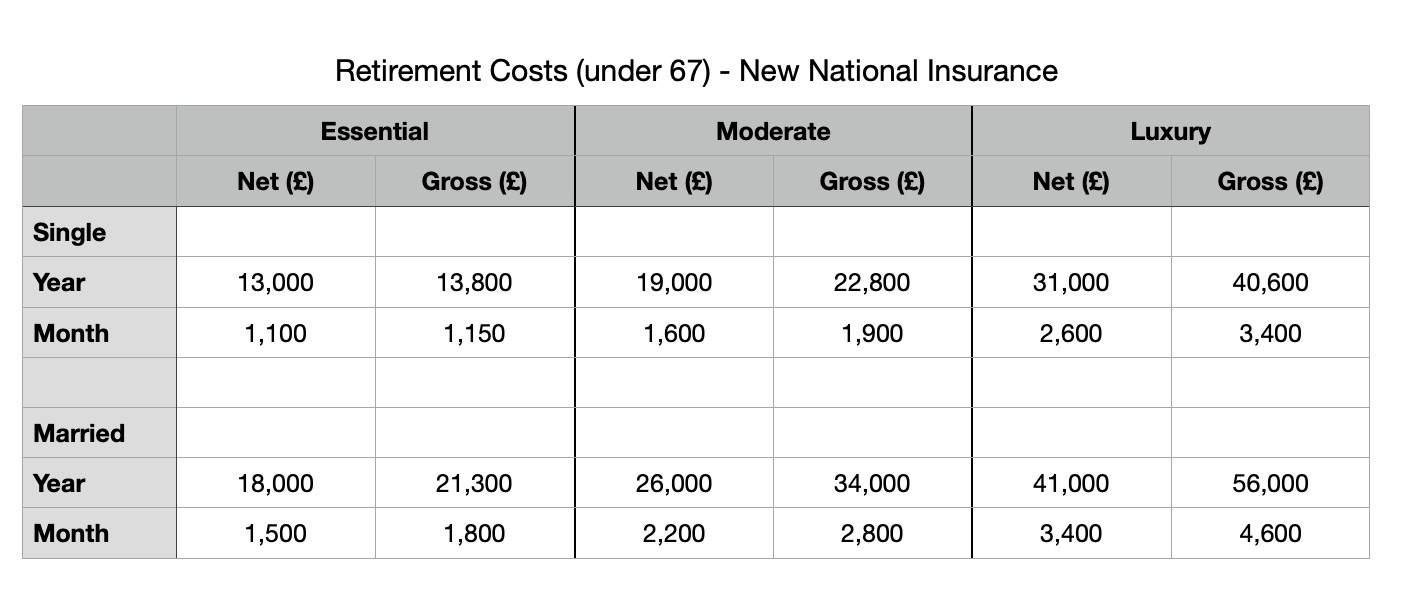

Last year, the Chancellor of the Exchequer (UK) announced an increase in National Insurance from 12% to 13.25% on earnings over £9,568 per year. At the time (see Issue -117: How to pay less tax in the UK?), I calculated its impact on the gross earnings needed to maintain a lifestyle. What I found was that it went from:

To:

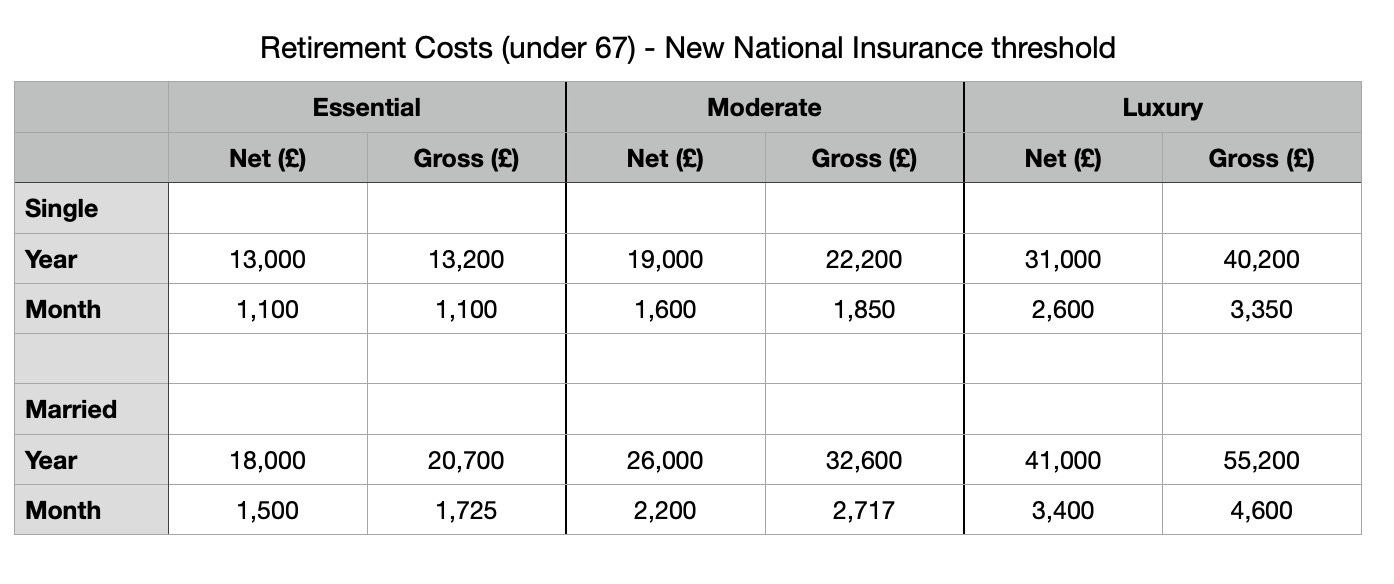

The Chancellor announced that the National Insurance threshold would be raised in July from £9,568 to £12,570 in the Spring Statement. So, what impact will that have on pensions? Well:

Overall, good news. The cost is reduced. Sadly, not back to before the increase in National Insurance, but it is reduced. The break-even point under the new scheme is about £41,000 gross, which would give a pension of £31,500. So, overall, the change in the National Insurance threshold is good news for pensioners.

There is also a drop of 1% on the basic income tax rate in 2024, to 19%. But, the tax threshold is frozen until 2025/26. And that is not good news.

The big problem is not tax but inflation.

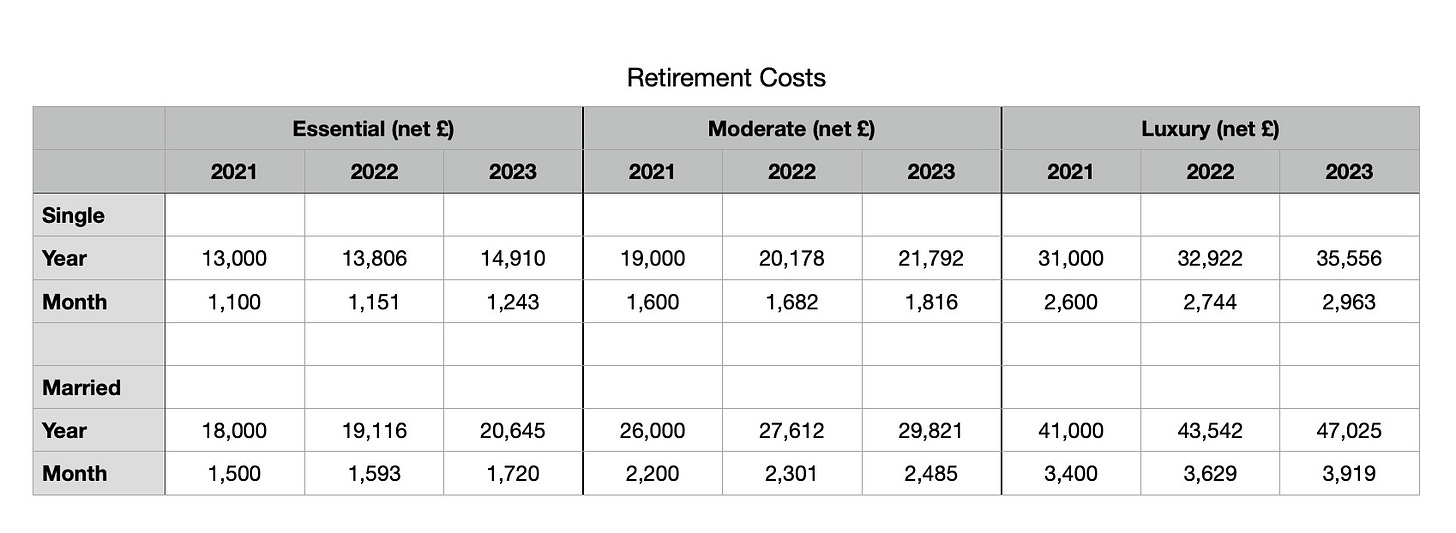

At the time of writing, the current rate of inflation in the UK is 6.2%, and the Bank of England is expecting inflation in the UK to be 8% in 2022. So, if we assume last year was 6.2% and this year is 8%, what will that do to the Essential, Moderate, and Essential retirement figures?

Well, it is not good…

These figures raise some worrying questions about my retirement plans. It could be time to rethink how I am handling my pension pots and whether I can make any changes to reduce expenses or boost income during my retirement.

Please note that I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. This is not financial advice.

Job

I reactivated the job list in the last review and I have kept an eye open for a new position. So far, I have not seen anything. Nothing has changed at work, and so I am still looking. However, with only 94 weeks to go, is changing jobs worth the time and effort?

Health

Last quarter, it was “All OK. I just need to drop a few pounds.”, since then, I have had another minor health scare, which is being looked at, and I hope will soon be resolved.

Meanwhile, I can concentrate on shedding a few pounds — which I have started to try to do.

Life

As I said in Issue -106 — “The life list has been a bit of a disaster, and I blame Christmas.” and I must admit, I have not made much progress. I am unsure what to do about the situation. On the plus side, some of the issues have been resolved, so I am making progress, but things are still sliding backwards. A cooling-off period may help?

One thing that has recently become clear is that I need to start thinking more about my post-retirement plans. I have some ‘pipe-dreams’ — see Issue -121: What am I going to do once I retire? — and those are the ‘big plans’. I must start thinking about the day-to-day stuff.

So, just as I said last quarter — “Over the next few months, I need to focus on the 'Life' list more.”

Summary

Overall, there are now some concerns. All four areas are now active and a worry.

Money — the change in the National Insurance is good news if your pension is below £41,000 gross. The big problem is inflation, which will make a big dent in the level of lifestyle I will be able to afford.

Job — do I stay, or do I go? This is the least worrying area, and I can ride out the 94 weeks.

Health — time for a diet!

Life — the ‘Life’ list is the biggest problem, and it needs some work. Let’s see how the next three months go.

Useful links

UK Government Website:

Next week

Next week, in issue -93, I will be looking at pension pots and how I will be able to have a better level of comfort in my retirement than I first thought with some careful juggling of funds.

Thanks

Thanks for reading this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you would like to say 'thanks' for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you have something you would like to contribute to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial advisor. When I am writing about money and financial matters, it is based on things I have read about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE.