The Retirement Newsletter: How much do you need to retire? The maths!

Issue Number: -119 — how to estimate how much you need to retire

Welcome

Welcome to issue -119 — and yes, I'm still counting down the weeks until I retire.

OK, so this week, the newsletter is a little 'UK heavy' as I will be looking at the impact of the UK tax system on our pensions. However, even if you are not a UK taxpayer, you may still want to read this week’s newsletter, particularly if you haven't thought about how tax may impact your pension.

This week I am going to look at how in issue -125 — The Retirement Newsletter: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement? — I estimated the amount of money you need to retire. Actually, I will be improving on the estimation technique I used in issue -125 and show you, if you are in the UK, how you can estimate your tax bill.

Health

OK, before I get into tax, a 'service announcement'.

If you have not had your COVID-19 jabs, or you have been offered a booster and not had it, please get jabbed against COVID-19. And while you are getting your COVID-19 jab, get the flu jab. It's going to be a bad winter for virus infections. We are already seeing some nasty 'simple' colds doing the rounds in the UK — Is 'the worst cold ever' going around? — BBC.

Money

OK, first off, I want to say that I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. The following is not financial advice.

I recently received an email about my maths in is issue -125 — How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement?.

So, a quick recap.

In Issue -125, I was writing about the three different lifestyles in retirement:

Essential — what is the least amount of money you need to survive? To live? To get by? Not the most comfortable way to be retired, but at least you can be retired and have some freedom, albeit limited by money.

Moderate — a comfortable retirement. A retirement where you are not overly limited by or worried about money. A retirement where you can travel and do the things you want to do.

Luxury — a retirement where money isn't a serious concern. You can't go mad with your spending, but you can afford some very nice holidays and have a very comfortable lifestyle.

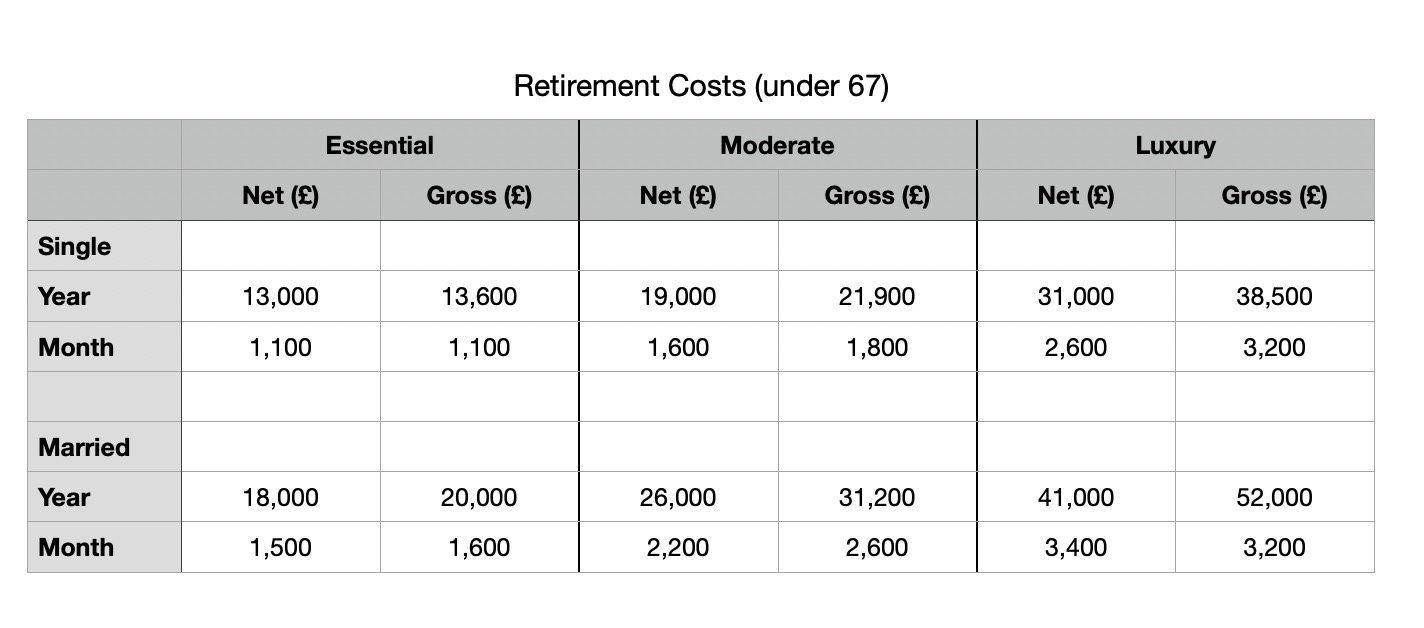

And I presented some figures derived from an article published in Which? magazine in May 2021 — How much will you need to retire?.

At the end of the article, I summarised the amounts with a table:

And I have been asked how I did the maths. First, I must admit that the above calculations took a relatively simple approach, and below I will show you a more accurate way to estimate your tax bill, assuming you have a standard tax liability and you do not exceed £50,000 gross per year.

Tax and National Insurance

In the UK, we have two taxes on our income — Income Tax and National Insurance. Income tax, you pay throughout your working and retired life, and National Insurance, you pay until your national retirement age, which is currently 67 years old.

The UK Government Income Tax rates and Personal Allowances website will, as the name suggests, give you information about your tax liabilities.

From the site, at the time of writing (October 2021), the personal tax allowance is £12,570, and the tax banding is:

Personal Allowance Up to £12,570 — 0%

Basic rate — £12,571 to £50,270 — 20%

Higher rate — £50,271 to £150,000 — 40%

Additional rate over £150,000 — 45%

So, suppose I look at the amount a single person would need to have an 'essentials' retirement on £13,000 net per year (see The Retirement Newsletter: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement?). So, on the first £12,579, they would pay no tax, and on the remaining money above £12,579, they would pay 20% tax.

The UK Government National Insurance website states in the How much you pay section that if you earn £184 to £967 a week (£797 to £4,189 a month) you pay 12% National Insurance tax and over £967 a week (£4,189 a month), an extra 2%. There are variations to these rates, and as I am not a financial advisor, so I will stick with the most simple maths.

National Insurance, like tax, has a 'threshold' which you have to reach before you start paying, and in 2021, that was £9,568 per year.

Now, this is where the maths gets a bit tricky, and in The Retirement Newsletter: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement? I did cheat as I used an over-simplified approximation.

What I did in the earlier newsletter was take the net, say £13,000, work out the tax I would pay on that, £13,000 - £12,579 = £421 taxable, £421 × 0.2 = £84.20, hence £84.20 tax bill. I then repeated the process for National Insurance, £13,000 - £9,568 = £3,432, and the tax, £3,432 × 0.12 = £411.84, so £411.84 National Insurance. I would then add these numbers to the £13,000 to give £13,500, which I rounded up. But there is a problem with this approach — it is a simplification as it does not consider the tax and National Insurance you would pay as your gross rises to £13,500.

Now, if £13,500 was correct, then when you put £13,500 into the government Estimate your Income Tax for the current year tax calculator, you should get an answer of £13,000 take home, but you don't, it comes out at £12,843.96. Close but not £13,000!

So, how can you get a more accurate figure?

If you call gross income G and your net income N, then the gross is equal to the net plus the tax and National Insurance paid. (I am assuming we are not dealing with upper tax and National Insurance threshold, plus that you are not over 67 years old which is when you stop paying National Insurance.)

Your tax is: (gross minus tax threshold) multiplied by the tax rate, so (G - 12579) × 0.20

Your National Insurance is: (gross minus National Insurance threshold) multiplied by National Insurance rate, so (G - 9568) × 0.12

Hence, net is equal to gross minus tax minus National Insurance:

N = G - Tax - National Insurance.

Now, if we build up the equation, we get:

N = G - (((G - 12579) × 0.20) + ((G - 9568) × 0.12))

As we want to know the Gross (G), we can rearrange the equation (have you broken out in a cold sweat as you remember 'high-school' maths?):

G = N + (((G - 12579) × 0.20) + ((G - 9568) × 0.12))

And after some rearrangement (who knew school algebra would be useful?), we get to:

G = (N - 3663.96) / 0.68

You should note that the above formula will only work for gross values below £50,000 because above £50,000 different tax and National Insurance thresholds apply. Plus, the calculation makes certain assumptions about National Insurance payments and does not consider tax arrangements for married couples.

So, for example, for our net of £13,000, we get:

G = (13000 - 3,663.96) / 0.68 = £13,729.47

And the Government website estimates that on a gross pay of £13,729.47; your net would be £13,000. Perfect!

For a net of £19,000:

G = (19000 - 3663.96) / 0.68 = £22,553

And the Government website estimates on a gross pay of £22,553; your net would be £19,000. Again, spot on.

So, that is how you can work out the gross income you will need for a net pension.

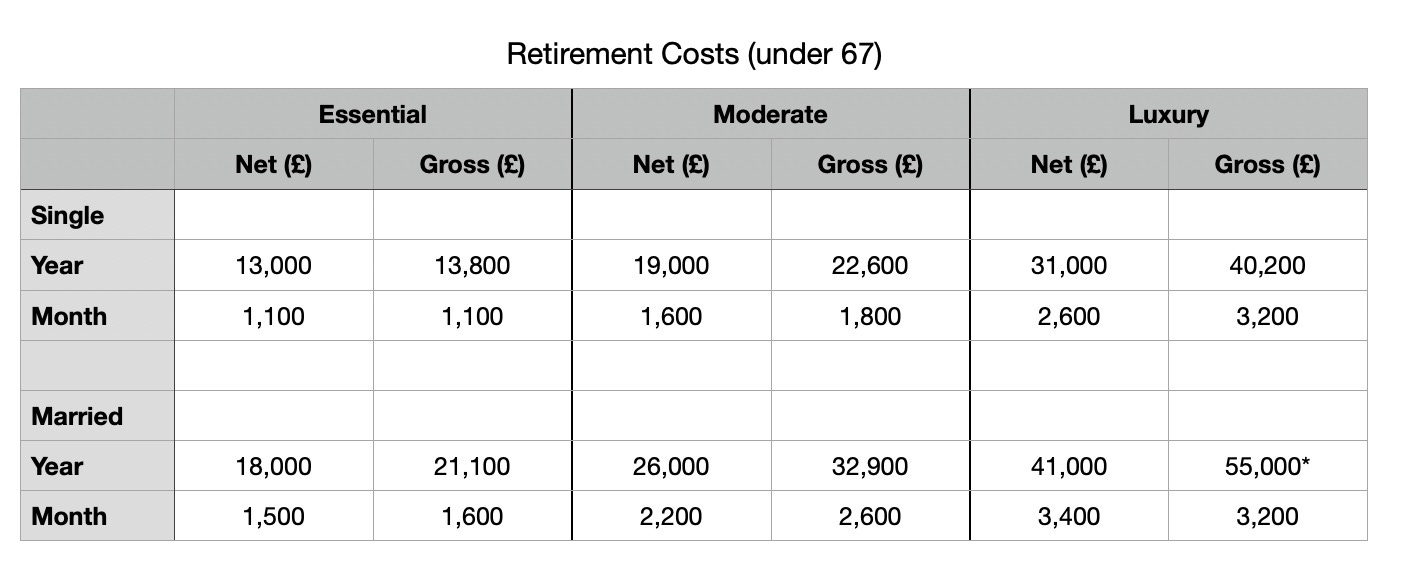

Based on my improved calculations, the table becomes:

So, some minor changes but nothing too significant, and please not for the ‘luxury net £41,000’, it is still an ‘old’ estimate as the gross is above £50,000.

Additional Help

If you are UK-based, here are the key websites that you might find useful in estimating the tax liability on your pension:

UK Government — Income Tax rates and Personal Allowances

UK Government — National Insurance

UK Government — Check your National Insurance record

UK Government — Estimate your Income Tax for the current year

UK Government — Check your State Pension forecast

Please note, I am not a financial advisor. All I am writing about here is what I have read over the years about money and preparing to retire. This is not financial advice.

Useful links

UK Government Website:

Next week

Next week I will look at what it’s like to be newly retired. What can we expect?

Thanks

Thanks for taking the time to read this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you would like to say 'thanks' for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you have something you would like to contribute to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial advisor. When I am writing about money and financial matters, it is based on things I have read over the years about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE.