The Retirement Newsletter: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement?

Issue Number: -125 — breaking down the costs

Photo by John McArthur on Unsplash

Welcome

Welcome to issue -125 — yes, I am still counting down the weeks until my planned retirement date.

125 weeks until I retire. It feels like it should be a milestone in some way — but I can't think of a way to capture it — anyway, 125 weeks to go.

Anyway, this week, the BIG question: how much could the essential, moderate, and luxury retirement plans cost?

Money

Please note: I am not a financial advisor. My writing on money and financial matters are based on things I have read about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE. The figures are for guidance and may not be correct.

In the last newsletter (What will be your type of retirement?) I wrote about three potential levels of retirement:

Essential — what is the least amount of money you need to survive? To live? To get by? Not the most comfortable way to be retired, but at least you can be retired and have some freedom, albeit limited by money.

Moderate — a comfortable retirement. A retirement where you are not overly limited by or worried about money. A retirement where you can travel and do things you want to do.

Luxury — a retirement where money isn't a serious concern. You can't go mad, but you can afford some very nice holidays and have a very comfortable lifestyle.

And asked, how much could they cost?

Well, luckily for us, the good folks over at Which? in the UK, have done a lot of the work for us.

In an article published in Which? in May 2021 — How much will you need to retire? — you will find a comprehensive breakdown of retirement costs for the UK. So, what did Which? find?

Well, Which? interviewed 6,800 retirees in the UK, and what they found was:

"Retirees in our survey spent around £2,170 a month per household."

This figure assumes that you have paid off the mortgage, and the figure is 'net', so you would need £26,000 per year post-tax.

In the UK, you pay tax on your pension income and, assuming you are under 67, National Insurance (another type of tax). If I factor in tax and National Insurance, £26,000 per year becomes £31,600 gross if under 67, and £29,400 if you are over 67 (currently, you stop paying National Insurance at 67). But, that is 'per household' and not per person.

The article goes further, and like I did in my last newsletter (What will be your type of retirement?) breaks down the costs into three retirement types — Essential, Comfortable and Luxury — except I had Essential, Moderate, and Luxury (I guess 'Comfortable' is a better term).

So, what are the final figures that Which? came up with for each group?

Essential

The figures from Which? for 'Essentials' are:

Single person: £13,000 per year net, or £1,100 per month

Household: £18,000 per year net, or £1,500 per month

In the UK, this would need a gross figure for a person under 67 of:

Single person: £13,600 per year gross (£1,100 per month, gross)

Household (assuming married person tax allowance): £20,000 per year gross (£1,600 per month, gross).

For a person over 67 in the UK (you currently stop paying National Insurance at 67), the gross figure would come to:

Single person: £13,600 per year gross (£1,100 per month, gross)

Household (assuming married person tax allowance, with both people over 67): £19,000 per year gross (£1,600 per month, gross)

The household numbers in this 'lifestyle' get tricky to work out because the income is close to UK tax thresholds, that is, the amount at which you start to pay tax, but these are as close as I can get.

Moderate (Comfortable)

The figures from Which? for 'Comfortable' are:

Single person: £19,000 per year net, or £1,600 per month

Household: £26,000 per year net, or £2,200 per month

In the UK, this would need a gross figure for a person under 67 of:

Single person: £21,900 per year gross (£1,800 per month, gross)

Household (assuming married person tax allowance): £31,200 per year gross (£2,600 per month, gross)

For a person over 67 in the UK, the gross figure would come to:

Single person: £20,600 per year gross (£1,700 per month, gross)

Household (assuming married person's tax allowance, with both people over 67): £29,000 per year gross (£2,400 per month, gross)

Luxury

The figures from Which? for 'Luxury' are:

Single person: £31,000 per year net, or £2,600 per month

Household: £41,000 per year net, or £3,400 per month

In the UK, this would need a gross figure for a person under 67 of:

Single person: £38,500 per year gross (£3,200 per month, gross)

Household (assuming married person tax allowance): £52,000 per year gross ($4,300 per month, gross)

For a person over 67 in the UK, the gross figure would come to:

Single person: £35,500 per year gross (£3,200 per month, gross)

Household (assuming married person tax allowance, with both people over 67): £47,800 per year gross (£4,000 per month, gross)

Summary

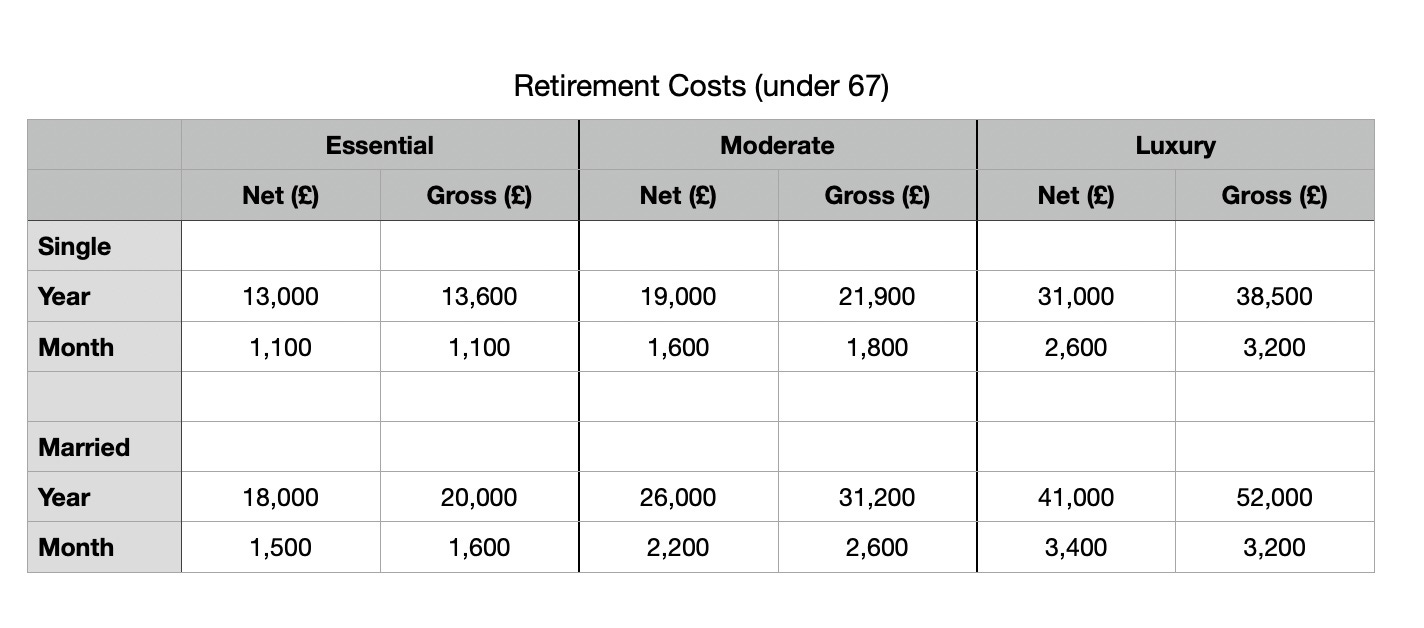

If the numbers in the Which? article are correct, then it suggests that you need at least £13,600 gross per year as a single person and £20,000 gross per year as a married couple (household) to be able to retire. I have summarised the costs in the table below:

So, anything above the 'essential' threshold is a bonus. The difference in income required between essential and moderate lifestyles is not too great. But, you will need to more than double your pension income to move from essential to luxury.

One final thought. In the UK, the state pension for a person is around £9,000 per year, and a married couple would get double this amount (there are many reasons why you may or may not get £9,000, and I won't go into them here — ask your financial advisor). With a UK State pension, a married couple would be in the 'essential' retirement group; a single person would not.

Please note: I am not a financial advisor. When I am writing about money and financial matters, it is based on things I have read over the years about money and about preparing to retire. THE ABOVE IS NOT FINANCIAL ADVICE. The figures are for guidance and may not be correct.

Useful links

UK Government Website — How to avoid pension scams

Next week

OK, so this week, I have focussed on retirement income in the UK; next week, I will take a brief look at retirement in the US.

Thanks

Thanks for taking the time to read this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you would like to say 'thanks for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you have something you would like to contribute to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial advisor. When I am writing about money and financial matters, I am writing about things I have read over the years about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE.