The Retirement Newsletter: Balancing the books — other income streams

Issue Number: -98 — Looking for other income streams

Welcome

Welcome to issue -98.

Last week — Issue -99: What does a comfortable retirement mean? — I looked at how much money you might need for a comfortable retirement, and it appears the figure is around £22,000 — £32,000 per year (depending on your marital status), and I am assuming that is gross, pre-tax. But what is a comfortable retirement?

Well, I defined the different levels of retirement in Issue -125: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement? as:

Essential — Not the most comfortable way to be retired, but at least you are retired and have some freedom, albeit limited by money.

Moderate — a comfortable retirement. A retirement where you are not limited by or worried about money. A retirement where you can travel and do things you want to do.

Luxury — a retirement where money isn't a serious concern. You can't go mad, but you can afford some very nice holidays and have a very comfortable lifestyle.

So, how can you move from one retirement level to the next? You need money!

Money

OK, first off, I want to say that I am not a financial advisor. I am writing about what I have read about money and preparing to retire. The following is not financial advice.

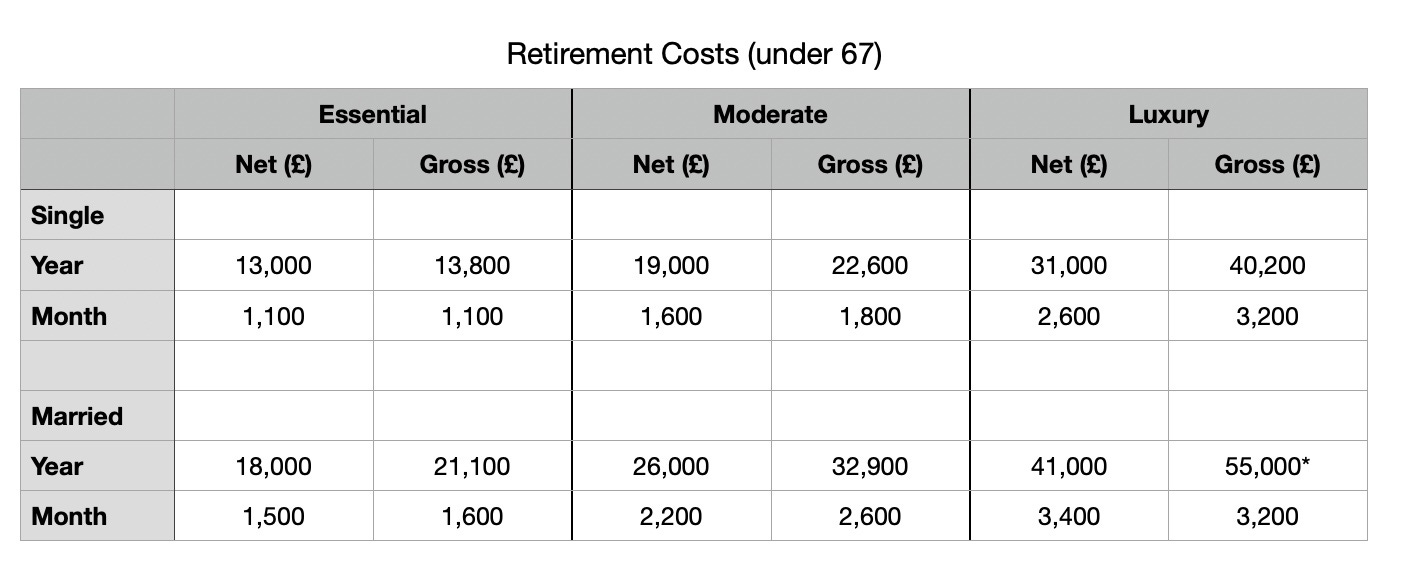

Last week, from Issue -119: How much do you need to retire? The maths!, I reintroduced the table of retirement levels:

I am not going to get into the sources of income. I will assume that a private pension or investment scheme provides the income. It could be an annuity, a final salary pension (now rare) or some other type of benefit. Anyway, whatever it is, I am assuming it is fixed, increases in line with inflation, and will last your retirement. Plus, I am assuming you have paid off the mortgage and are not carrying any significant debts. (Yes, I know there are many assumptions, but there are too many variables to make sense of what I am attempting to say without them.)

The easiest move, and I would argue the most beneficial, is to go from 'Essential' to 'Moderate' (Comfortable) as that will have the most significant impact on the quality of your retirement. But, how can you do that? Where can you get the money?

A pre-tax income of £13,800 (single) or £21,100 (married) will give you an 'Essential' level of retirement. You will be retired, but you won't have many options. If you could move to the 'Moderate' (Comfortable) level, things get a lot better.

As a single person, you need to move from £13,800 to £22,600 per year; you have to find £7,300 per year gross (£610 per month). A married couple would have to go from £21,100 to £32,900 per year gross, an increase of £11,800 per year, or £980 per month.

And this, at least in the UK, is where it gets interesting. At 67, the State pension starts, assuming you have paid sufficient National Insurance (see last week's issue and my National Insurance scare — Issue -99: What does a comfortable retirement mean?), you will receive more than the required £7,300 per year for singles and £11,800 per year for a married couple. The State Pension will move you from 'Essential' to 'Moderate'.

If you retire early on an 'Essential' level in the UK, all you need to do is 'find' the money to bridge the gap from' Essential' to 'Moderate' until the State pension kicks in. Plus, at 67, you will no longer pay National Insurance on your income, hence a bit more money in the pot.

So, how can you bridge the gap? Well, there are five ways I can see of bridging the gap:

Sell a kidney

Get a job

Plan to decrease your savings in a controlled way to meet the shortfall

Set up a side-hustle to make some money

Rob a bank

Now, if we are honest, 1 and 5 are out. You made need the kidney, and robbing a bank is risky and doesn't make for a relaxed retirement. This leaves 2, 3 and 4.

Get a job

OK, so you can make up the shortfall by getting a part-time job. But getting a job may not be easy.

Depending on your circumstances, you need to make £7,300 to £11,800 per year gross to move from 'Essential' to 'Moderate'. Or put another way, £140 to £225 per week. If the average weekly pay in the UK is about £550 per week (Office of National Statistics) then you would have to work 1.25 to 2 days per week. If you worked in a UK supermarket, you could expect £9 — £11 per hour, so you would need 15 to 25 hours per week, or 13 to 20 hours per week, depending on your hourly rate. So, assuming a 7-hour workday, 2 to 3 days per week.

No matter how you look at it, you will need to work at least 2 days per week to bridge the gap. Is that being retired? I don't think so. Is there a better way?

Savings

Another way of bridging the gap between an 'Essential' and 'Moderate' retirement is to tap into your savings or any pension lump sum. And I will have a look at this approach in a few weeks in Issue -93. (So it is worth Subscribing now, so you get that issue in your email.)

Side-hustle

Finally, option 4 — the side-hustle.

A side-hustle is a way of making a bit of money 'on the side'. Hence, this is similar to option 2, getting a job, and the same maths needs to apply. That is, you have to make £7,300 to £11,800 per year gross to move from 'Essential' to 'Moderate'. But, a side-hustle is different to getting a job as you are the boss. You are self-employed. You dictate on what, when and where you work. And, hopefully, the side-hustle is something you enjoy doing.

I will look at side-hustles more next week.

Please note, I am not a financial advisor. I am writing about what I have read about money and preparing to retire. The above is not financial advice.

Useful links

UK Government Website:

Next week

Next week, in issue -97, I will look at using a side-hustle to make up the difference between an 'Essentials' retirement and a 'Moderate' (Comfortable) retirement.

Thanks

Thanks for taking the time to read this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you would like to say 'thanks' for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you have something you would like to contribute to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial advisor. When I am writing about money and financial matters, it is based on things I have read about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE.