The Retirement Newsletter: What does a comfortable retirement mean?

Issue Number: -99 — How much do I need to be comfortably retired?

Welcome

Welcome to newsletter -99 — my first negative double-digit newsletter.

I am still busy counting down the weeks until I retire — 99 to go.

This week, I am revisiting how much money I would need for a comfortable retirement. And this was all brought about by an article I read in The Telegraph in the UK — How much does a comfortable retirement really cost?

If you are not familiar with the UK daily newspapers, the best description I have heard of them came from the fictional Prime Minister, Jim Hacker, in the BBC TV series called 'Yes Prime Minister'. The series was broadcast in the 1980s and is still relevant today. So, how did he describe the daily newspapers?

"Don't tell me about the press. I know exactly who reads the papers. The Daily Mirror is read by people who think they run the country; The Guardian is read by people who think they ought to run the country; The Times is read by the people who actually do run the country; the Daily Mail is read by the wives of the people who run the country; the Financial Times is read by people who own the country; the Morning Star is read by people who think the country ought to be run by another country, and the Daily Telegraph is read by people who think it is." — Hacker, Series 2, Episode 4, 1986

And I can't repeat what he said about The Sun Newspaper. You can watch the clip on YouTube.

So, what was the conclusion of the 11th February 2022 article in the Telegraph?

How much does a comfortable retirement cost?

Well, according to The Telegraph (also known as the Tory-graph in the UK), an annual income of £31,000 would fund a 'luxury' retirement lifestyle.

So, how did they come to this figure?

Well, it turns out they did what I did in:

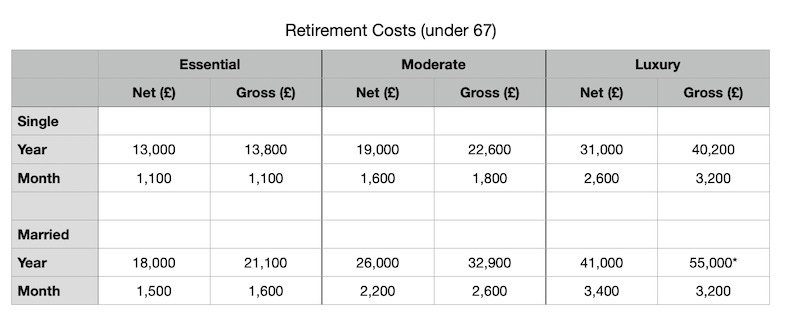

They used the Which? magazine figures from May 2021. So, nothing new! And, as I said in Issue -119: How much do you need to retire? The maths!, the numbers look a bit like this if you are under 67 in the UK.

So, I would argue that the £31,000 they quote in the article, assuming it is net, would fund a luxury lifestyle for a single person or a very comfortable lifestyle for a married couple. If their figure is gross (pre-tax), then it is a different story. (If you are wondering about the different lifestyles — Essential, Moderate, and Luxury — then have a look at Issue -125: How much money will I need for an Essential, Moderate (Comfortable) or Luxury retirement?)

If you are over 67, these numbers look slightly different in the UK as you no longer pay National Insurance. Plus, you get a State pension added to your income. That is, your tax burden decreases and your income increases.

However, what the Telegraph piece has done, and I haven't got around to writing about, is factoring in the UK State Pension. The article also gives a handy table of savings rates needed to achieve the Essential, Comfortable and Luxury lifestyles.

Anyway, it is worth a look as the piece highlights the importance of considering all your pension pot, which got me thinking. Are mine OK? And then I read an article about contracting out of National Insurance in the UK (National Insurance pays for your pension), and I had a sudden panic.

National Insurance (UK)

I did have a bit of a panic this week about my UK National Insurance contributions. I suddenly thought I might not get my state pension when I turn 67.

I have checked my contributions — Check your National Insurance record and Check your State Pension forecast — and thought everything was OK. But, having read a piece in a UK money magazine, I thought that I might have been contracted (sometimes called opted) out of the State pension scheme.

A few years ago, when private pensions in the UK were being reorganised, there was an option to be contracted out of the State pension. Being contracting out meant you paid less National Insurance. The idea was these savings were then put into your private pension. And I can remember being offered this.

Did I contract out? I hope not! But how can I check?

Well, it all comes down to National Insurance codes, and you can find your code on your payslip.

At the time of writing (February 2022), the codes are:

A — All employees apart from those in groups B, C, J, H, M and Z below

B — Married women and widows entitled to pay reduced National Insurance

C — Employees over the State Pension age

J — Employees who can defer National Insurance because they're already paying it in another job

H — Apprentice under 25

M — Employees under 21

Z — Employees under 21 who can defer National Insurance because they're already paying it in another job

I am code A — phew! I have not contracted out!

Panic over.

The key National Insurance codes to look out for on your payslips are D or N. And, these codes don't appear on the National Insurance rates and categories.

Anyway, don't forget to check your National Insurance code. You can find full details at National Insurance rates and categories. And, if you think you were contracted out and you prefer not to be, then speak to your employer or a financial adviser.

Useful links

UK Government Website:

Next week

Next week is issue -98, and I will be looking at balancing the books in your retirement and thinking about other incomes.

Thanks

Thanks for taking the time to read this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you would like to say 'thanks' for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you have something you would like to contribute to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial adviser. When I am writing about money and financial matters, it is based on things I have read about money and about preparing to retire. IT IS NOT FINANCIAL ADVICE.