The Retirement Newsletter: When should I retire?

Issue Number: -35 — Five reasons to retire as planned and five reasons to delay

Welcome

Welcome, to issue -35 —when should I retire?

This seems like an easy question, but I am wondering if I have it right as I get closer to the date — only 35 weeks to go. Yes, it is another wobble.

Retirement Date

I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. What follows is not financial advice.

How did I determine the date on which I would retire? Well, the big deciding fact for me was money. When would I have enough to retire?

Early on in these newsletters — August 2021 in Issue Number: -126 — What will be your type of retirement? — I defined three levels of retirement:

Essential — what is the minimum amount of money you need to survive? To live? To get by? Not the most comfortable way to be retired, but at least you can be retired and have some freedom, albeit limited by money.

Moderate — a comfortable retirement. A retirement where you are not overly limited by money. A retirement where you can travel and do things you want to do.

Luxury — a retirement where money isn't a serious concern. You can't go mad, but you can afford some very nice holidays and have a very comfortable lifestyle.

And while I have always accepted that I will never get to 'luxury', I have been aiming for 'moderate'.

But how much money do I need?

Well, in my last quarterly review — Issue -42: Quarterly review — end of quarter 1 2023 — I wrote about an article in the Times newspaper that said you need about £520k for a 'moderate' retirement (see, You need about £520k for a 'moderate' retirement. Gulp — Holly Mead). And I concluded that I was nowhere near that amount.

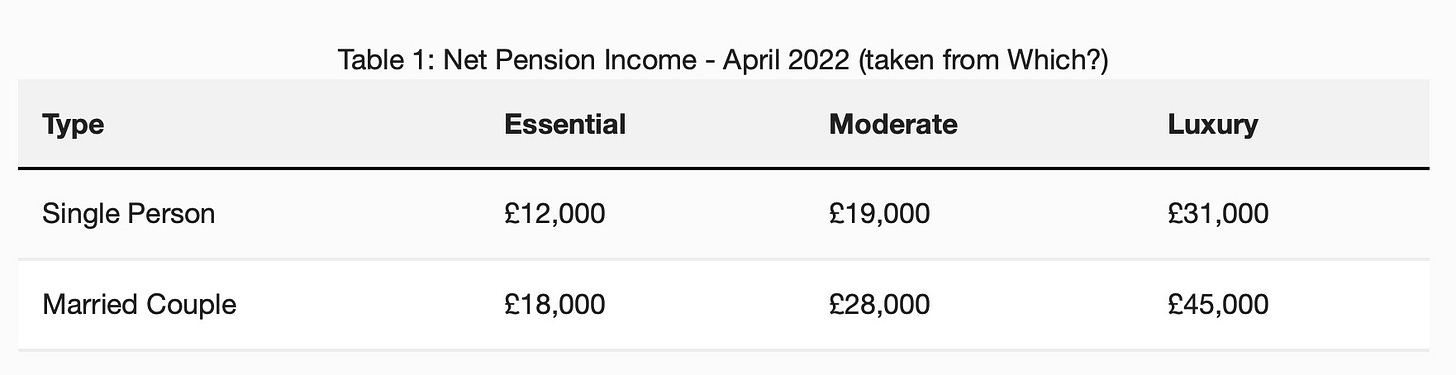

In issue -62, Looks like I had my pension income maths wrong, I came to the figures (Table 1), based on information in Which? of:

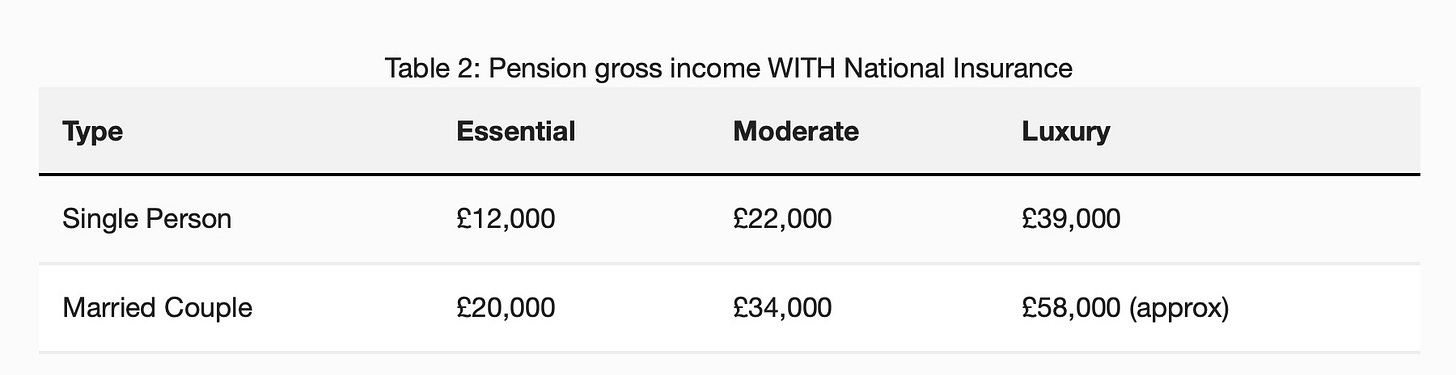

Once I factored in National Insurance payments (assuming I retire before the official retirement age and I continue to pay National Insurance, so I get the full state pension) and Income Tax (Table 2), the gross figures are:

And so, for a moderate retirement, I would need £22,000 to £34,000 per year, gross.

And this has been the significant deciding factor for the date when I retire — when can I hit the magic number?

One thing that I have factored into my decision is that my pension has a 'bump' in it.

One of my pension pots gets a bonus for each year I don't retire; the pension increases by a certain amount. The amount is constant, except when I stepped out of my 50s and into my 60s. That year the 'bump' was double, so it was sensible for me to hang on until I was over 60.

If you are considering early retirement, check your pension for 'bumps' in income related to age. It may be worth delaying retirement until you hit a certain age.

Should I stick to my planned date or change it?

Please note I am not a financial advisor. I am writing about what I have read over the years about money and preparing to retire. The above is not financial advice.

Reasons to Stick to the Date

Five reasons to stick to my planned date:

1. I have a plan

Well, I do. I have been planning my retirement for years, and I have a plan.

Will my plan work? Who knows? But if I don't try it, I will never find out.

2. I can afford it

I can afford to retire in 35 weeks if my maths is correct.

3. It is time for a change

I need a change. I have been doing the same job for about 25 years and want to try new things. I need the change.

4. If not now, then when?

If I don't retire now, then when do I retire?

The only thing holding me back are my money worries — do I have enough to retire? I think I do.

If I delay my retirement to grow my pension pots, they will not get much bigger in the next two to three years.

And, as a retired friend recently said — " You will never have enough money to retire, so you may as well retire now."

5. I have things I want to do while I still can!

I have many things I would like to do.

Writing the "Travel — Nostalgia Corner" each week has made me realise how much I miss travelling and exploring. I hope to do more travelling when I am retired.

Reasons to Change the Date

Five reasons not to stick to my planned date:

1. I can't afford it

A lack of money in my retirement is my biggest concern.

Early in my career, particularly as a student and during training, I didn't earn much, and money was tight. And I did not enjoy having money worries.

2. I am still enjoying my job

I enjoy most of my job and will miss bits when I retire. I will miss most, but not all, of my students. I will miss preparing and giving lectures. I won't miss exams (see Issue -37: My last set of summer exams) or marking. And I won't miss a lot of the meetings.

I will miss some of my colleagues.

3. I have things I want to do in my career

I haven't finished with my 'job'. There is more that I can do. There is stuff that I would like to do. But there will always be that 'next thing'. It's time to realise that I can't fix and change everything. All I can hope is that I leave things in a better state than I found them.

4. I'm too young to retire

This is 'imposter syndrome' doing its thing — " you are too young to retire".

I explored this problem in depth in Issue Number: -51: Am I ready to retire?, where I decided that the best way to deal with being ready to retire was to reframe the question.

5. I'm scared

OK, I admit it. I am scared. The thought of retiring I find frightening. If I don't retire, I am not scared.

Summary — when should I retire?

Well, five reasons to retire as planned, and five not.

After careful consideration, the 'retired as planned' has it.

Travel — Nostalgia Corner

This week I wrap up my skiing adventure in the Part City area and move on to explore Zion National Park.

Skiing Snowbird and Alta, Utah — a great experience, and why I was glad I had insured the skis

Last day of skiing — Solitude or Brighton? — where did I go?

Back on the road — driving from Park City to Zion National Park — I do enjoy a road trip in the US.

Next week, exploring Zion National Park — a magical experience as we visited in early season before the crowds arrived.

Next week

Next week, in issue -34, I celebrate my last set of summer exam marking and share with you the magic that is Zion National Park.

Thanks

Thanks for taking the time to read this newsletter, and please don't hesitate to share it with your friends or on social media using the buttons below.

If you want to say 'thanks' for the newsletter, why not buy me a cup of tea?

Until next time,

Nick

PS, If you want to contribute something to the newsletter — a story, advice, anything — please get in touch.

Please note: I am not a financial advisor. The information I share regarding money and financial matters stems from reading and researching money management and retirement planning. IT IS NOT FINANCIAL ADVICE.